Public Mutual Private Retirement Scheme

The prs is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund.

Public mutual private retirement scheme. Public mutual s six private retirement scheme. 8 rhb asset management sdn. You can choose any fund to invest according to your own risk preference and retirement goal. A copy of the disclosure document and phs of public mutual private retirement scheme conventional series and public mutual private retirement scheme shariah based series can be viewed here.

Public mutual private retirement scheme shariah based series scheme trustee. This is especially useful for those who wish to grow their retirement fund and invest but aren t savvy in the area of investment. Public mutual is malaysia s largest private unit trust company with more than 160 unit trust funds under its management and is an approved private retirement scheme prs provider managing nine prs funds. 7 public mutual berhad.

Each prs provider offers a scheme to the public which comprises various retirement funds. Funds comprising conventional and syariah based series to help individuals accumulate savings for retirement were recently launched. Each retirement fund varies in terms of asset allocation and product mix. Contributors should understand the risks of the fund s compare and consider the fees charges and costs involved in contributing to prs fund s.

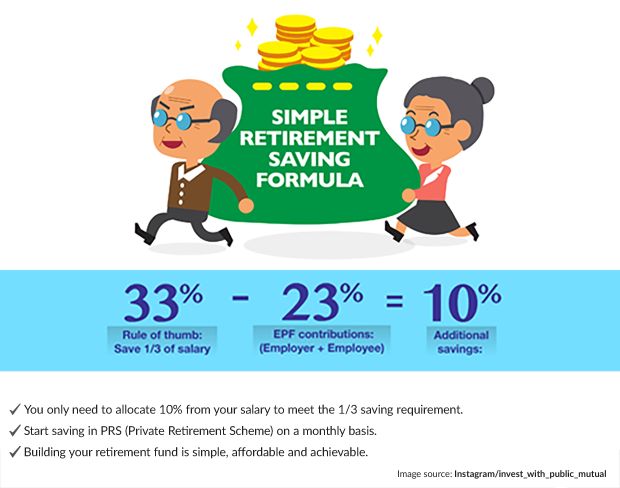

Private retirement scheme prs pre retirement withdrawal prs members can make pre retirement withdrawals for permanent total disablement ptd serious disease sd and mental disability md with effect from 1 august 2017. The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. At public mutual we provide a wide range of prs funds that you may choose to contribute to based on your contributon time horizon risk appetite and age.